A deep dive into the trillion-dollar opportunity that could transform women’s health care.

Key points

- The femtech sector is estimated to be worth $4.8 trillion by 2025.

- The underrepresentation of women in health data and the tech ecosystem, especially in VC investment, poses obstacles for the industry.

- If investors can get past the cultural taboos, femtech’s growth trajectory presents a compelling opportunity for investors to tap into a market with vast potential and unmet needs.

In 2014, Apple unveiled its Health app, a central repository for data about a person’s health and fitness. Suddenly, iPhone users (and, eventually, iWatch wearers) had the ability to track not just their diet, exercise, and medical records, but newfangled things like sleep habits, heart rate, blood alcohol content, inhaler usage, height (for those still growing), plus calorie and sodium intake. Apple’s software executive, Craig Federighi, boasted at the launch event, “with Health, you can monitor all of your metrics that you’re most interested in.”

All but one.

Apple managed to omit a critical health data point that concerns over half the human race: the menstrual cycle. People who menstruate, afterall, have monitored their period for centuries as a fertility and contraceptive method, and physicians routinely ask female patients about their flow and regularity. Menstrual cycle tracking is a fundamental aspect of biological health, so having all your health metrics in a single app named “Health” seemed like a no-brainer.

Although Apple did eventually add the feature, it’s a case study in how the tech sector has traditionally overlooked a significant market (not to mention, a reminder of the need for more women in STEM). It also illustrates why the “femtech” industry is flourishing.

What is femtech

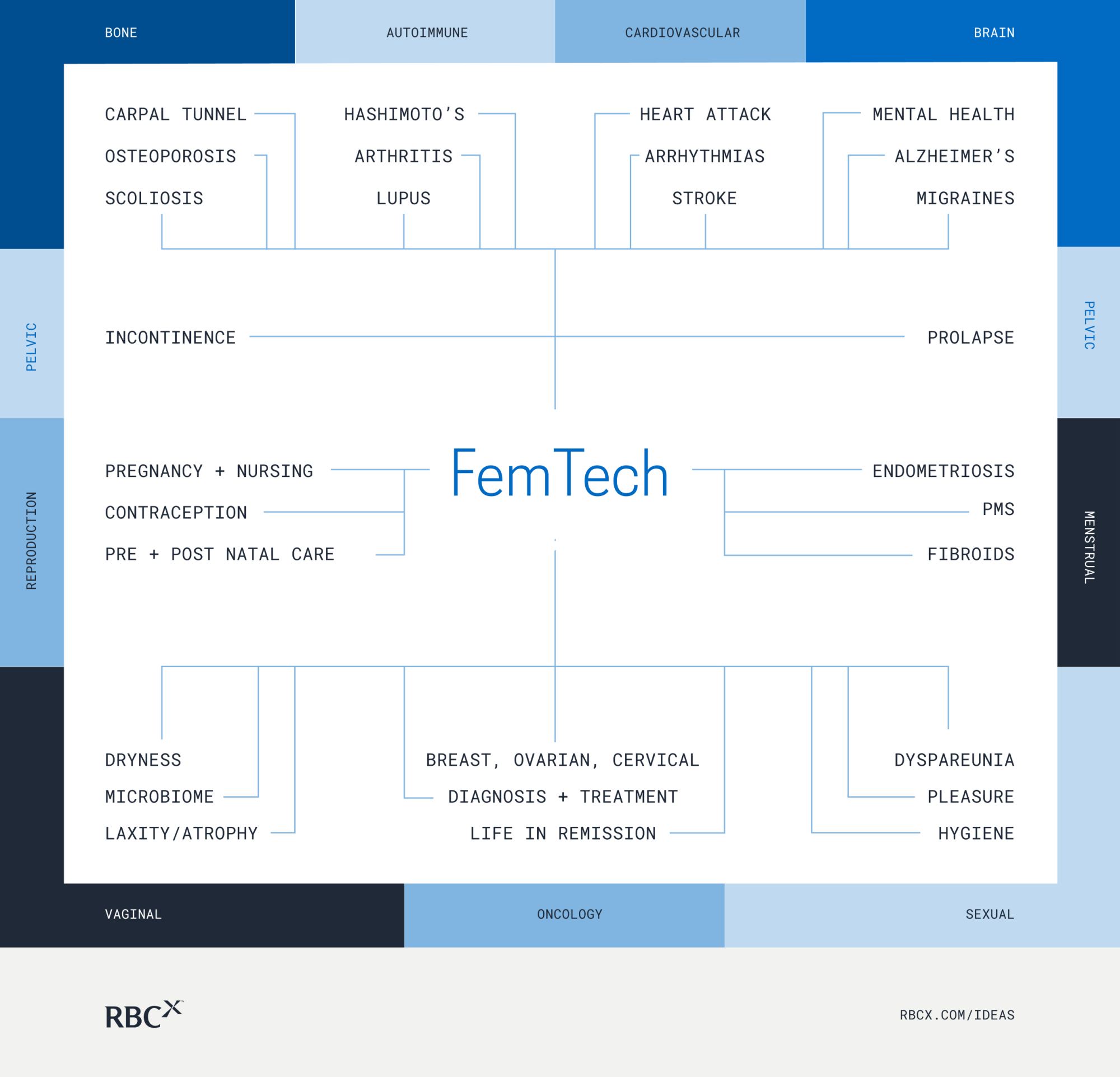

Femtech, short for female technology, refers to a burgeoning sector that caters to the specific health needs that solely, differently, or disproportionately impact women, girls, non-binary and trans folks, as well as those assigned female at birth. It covers everything from fertility and pregnancy monitoring apps, to sexual wellness and pelvic health devices, to menopause management tools.

Indeed, a whole “menotech” subsector has sprung up (funded, in part, by high-wattage celebrities like Gwyneth Paltrow and Naomi Watts), which hopes to tap into the over one billion people worldwide who experience menopausal side effects.

However, it’s not just about periods and pregnancy. This groundbreaking field of technology-based products is driving innovation in chronic medical conditions in which symptoms present differently or are diagnosed later, such as Alzheimer’s, autoimmune and cardiovascular diseases, hormonal disorders, cancer, migraines, and so much more—meaning that practically no area is off limits.

The term “femtech” was coined in 2016 by Danish entrepreneur Ida Tin, co-founder and CEO of Clue, a menstrual and tracking app. “I thought, what if we had a term that could put them all in one category?” she said. “That felt empowering. But it also felt like it would be easier for investors and media to go find these companies and to talk about them.”

Femtech’s hockey stick moment

There are now over 1,800 companies worldwide categorized as femtech and, over the last decade, the sector has grown to encompass all products, services, diagnostic tools, therapeutics, wearables, and software created to improve disparities in women’s health and experiences. More than 60 per cent of femtech startups were founded in the five years leading to 2022, and there has been a 1,000 per cent increase in the number of businesses in the space over the last decade, according to FemHealth Insights research.

With a global market of nearly four billion women (i.e. over half of the planet’s population), the overall sector is set to be worth over $1 trillion by 2027, according to non-profit organization FemTech Focus. Femtech Canada, an organization dedicated to advancing women’s health innovation, commercialization, and investment, predicts it could exceed $4.8 trillion by next year.

We’re in a new frontier of women’s wellness, but despite its immense potential (and profits), femtech faces myriad challenges due to a range of systemic barriers in accessing health care innovation, especially over the lines of race, gender, and class. Whether it’s a lack of understanding, underinvestment, or social stigma, these challenges create a self-reinforcing cycle that makes it more difficult for female founders to access the capital and resources necessary to bring their ventures to fruition.

Femtech barriers to entry

Research & running the regulatory gauntlet

Tech for female health, like the health care industry at large, is subject to stringent oversight to ensure user safety and data privacy. In North America, this requires obtaining approvals from government bodies like Health Canada and the FDA, as well as navigating a hodgepodge of health care standards and regulatory frameworks in order to scale globally.

The historical and systematic exclusion of women from medical research—women were banned from most clinical trials until 1997 in Canada and 1993 in the U.S.—and the ongoing neglect of female-specific health conditions by the medical and scientific communities has led to a dearth in the very data needed to gain regulatory approvals. The burden of conducting expensive and time-intensive clinical trials and obtaining certifications then often falls on the femtech founder.

Femtech funding: Why most VCs don’t invest in femtech startups

Venture capital can help bridge the knowledge gap by bankrolling research studies, but investors themselves rely on this data to determine the types of deals they fund. “What gets measured gets managed,” one femtech founder told RBCx, underscoring the cyclical problem.

Investors’ short-term focus also hinders funding. VCs often prioritize quick returns over moonshot investments, but femtech startups usually need longer-term horizons for R&D, approvals, and market adoption.

The uber-male dominance within the venture capital industry further compounds these issues. Most femtech startups are led by women, yet female tech founders consistently receive a disproportionately smaller share of funding—just 10 per cent of all deals in Canada since 2014—and fewer opportunities to scale their ventures.

While personal understanding of a product is often key in steering VC decision making, male investors are often unaware or reluctant to discuss women’s health issues and the importance of women’s health solutions. Kathrin Folkendt, CEO & Founder of Femtech Insider, an online platform for all things women’s innovation, revealed in a recent webinar that she’s regularly brought in to educate male venture capitalists about the industry’s mammoth market potential: “‘Why should we invest in a space that ignores 50 per cent of the market?’, ‘We already invested in a femtech company,’ ‘Is this really a big problem? If it is, I would have heard of it.’ These are just some of the statements I hear from VCs. It’s really difficult sometimes.”

A lack of understanding about female anatomy doesn’t help, either. Rachel Bartholomew, founder of women’s pelvic health solutions startup Hyivy (and Femtech Canada) adds: “I spend a lot of time educating VCs and talking to their wives or daughters who get brought in to help them understand and validate why this is important.”

Education

Educating health care professionals and end users about the benefits and correct usage of these technologies poses additional challenges for the industry. Getting doctors, gynecologists, or other health care providers onboard to integrate femtech solutions into their practices can require a herculean effort. Insurance companies unwilling to cover the costs make access more challenging as consumers have to shoulder the out-of-pocket costs, leaving lower income-women underserved.

Initiatives to educate wider audiences through traditional social media marketing and advertising can also be hampered due to the taboo nature of women’s bodies. For example, it can be a struggle for a femtech startup focused on breast health to promote its product to target customers when certain platforms (looking at you, Instagram) deem a display of women’s nipples as a violation of their policies.

The future is bright for femtech

But where there’s taboo, there’s neglect—which translates to opportunity. Global venture capital has pumped close to $20 billion into the femtech sector and that number is only expected to grow.

Nurturing innovation within the female health space doesn’t just benefit women. A McKinsey study on femtech found that “across the value chain, a more inclusive, gender-aware healthcare system could help support more women to become inventors, investors, physicians, founders—and healthier human beings, solving for the health conditions of other human beings. Research has shown that when inventors set out to solve a health problem, male inventors are more likely to solve for a male-oriented condition; women-led teams solve for both.”

Further research by Women’s Health Access Matters, a nonprofit organization focused on funding for women’s health research, suggests that a $300 million investment into improving female health could generate around $13 billion for the global economy.

The market opportunity is clear. Investing in and supporting the femtech sector fuels overall innovation and increases the size of the pie.

“The market opportunity is clear,” says Parneet Dehl, who as Vice-President in RBCx’s Life Sciences practice, works directly with femtech clients. “Investing in and supporting the femtech sector fuels overall innovation and increases the size of the pie.”

Frequently asked questions about femtech

What is femtech?

A subsector of the tech industry focused on innovative solutions to address the health needs that solely, predominantly, or differently impact the health of women, girls, non-binary and trans folks, as well as those assigned female at birth.

What is a femtech company?

A femtech company is an enterprise that specializes in developing technology-driven solutions to address unmet needs in diseases, conditions, and indications that solely, predominantly, or differently impact the health of women. These companies create innovative products and services (e.g. diagnostic tools, devices, therapeutics, wearables, and software/apps), ranging from fertility tracking apps and pregnancy monitors, to pelvic health devices and menstrual cycle management tools, with a focus on empowering women to take charge of their unique health needs.

Is femtech the right term to use to discuss this space?

Yes and no. Critics see the term as overly broad and it potentially reinforces gender stereotypes by associating certain technologies solely with women to the exclusion of trans and non-binary individuals. Some argue that using a gender-specific label for technology can perpetuate the idea that women’s health is a niche or separate category, rather than an integral part of overall health care.

Additionally, there is a concern that the term may oversimplify the diverse needs and experiences of women, as it tends to focus primarily on reproductive and maternal health. Regardless, many still see value in bringing focus to the vast disparities, bias, and neglect in health care (women were excluded from most life sciences research and clinical trials until 1997 in Canada, and 1993 in the U.S.) as well as tech design.

What are the challenges faced by female entrepreneurs?

Despite its immense potential, the femtech industry faces notable obstacles. Regulatory challenges, stringent validation requirements, data privacy concerns, and the need for health care professional adoption are hurdles femtech startups must navigate. Moreover, the sector spans a diverse and wide spectrum of women’s health, leading to market fragmentation and the challenge of finding a specific niche.

Arguably the most significant challenge femtech faces, however, is the historical underinvestment by venture capital. The industry has been overlooked, underestimated, and underfunded partly due to the lack of understanding among predominantly male investors. Societal taboos and biases around women’s health topics have further contributed to femtech being perceived as a niche market.