John is a member of RBCx’s banking team, where he predominantly supports early-stage clients across capital fundraising and strategic growth. In addition to this role, John works alongside RBCx’s capital team on both direct, indirect (fund-of-funds), and strategic investment opportunities.

Ideas Worth Noting

For readers with only a few minutes to spare, here are this piece’s key takeaways

- Role of VCs. As the majority of tech companies are cash-burning enterprises, our ecosystem has relied heavily on venture capital partners to scale. For VCs to carry out their role, they must establish and nurture trusted LP relationships, maintain a healthy flow of qualified companies to deploy capital into, and cultivate a liquid private/public capital markets landscape to exit out of. Over the past decade, and especially over our black-swan bull, this has all held true.

- Government-induced liquidity. As central banks thumbed the scales in favour of equities and alternatives during our black-swan bull, primarily driven by record quantitative easing and rate cuts, both VC fundraising (from LPs) and deployment (from GPs) broke records. With a public market flushed with new, government-induced liquidity, our private tech ecosystem graduated a record number of companies to the public markets (both through IPO and SPAC). This further incentivized VCs to deploy a record amount of capital, as they saw their primary vector for liquidity thrive.

- Rate impacting venture capital. As 2022 instilled a sudden realization that central banks enabled a record negative real interest rate, they quickly came off cruise control and battled 40-year record inflation with steep rate hikes. Not only do rate hikes drive investors to reallocate capital away from growth assets and into higher-yielding bond alternatives, but they also have an inordinate impact on tech valuations, discounting future-year cash flows by a steeper rate. Specifically, studies estimate that a 1% rate increase decreases VC fundraising by 3.2% and increases VC investment demand by 2.5% – establishing a sizable capital supply-and-demand imbalance.

- VC deployment and fundraising outlook. As VCs prioritize a flight to quality – capital deployment cycles will revert to the standard 3-year period, resulting in fewer completed deals and capital deployed, comparatively to 2021. As for VC fundraising, the $120B recorded in H1 2022 was primarily driven from fundraisings kicked off during Q4 2021, given the typical 6-9 month fundraising/announcement lag for venture. As LPs have seen their public portfolios battered while private valuations holding steady (given the lack of real-time liquidity), we can expect heavily-slowed financings ahead – especially as their public market investment off-ramp remains shut.

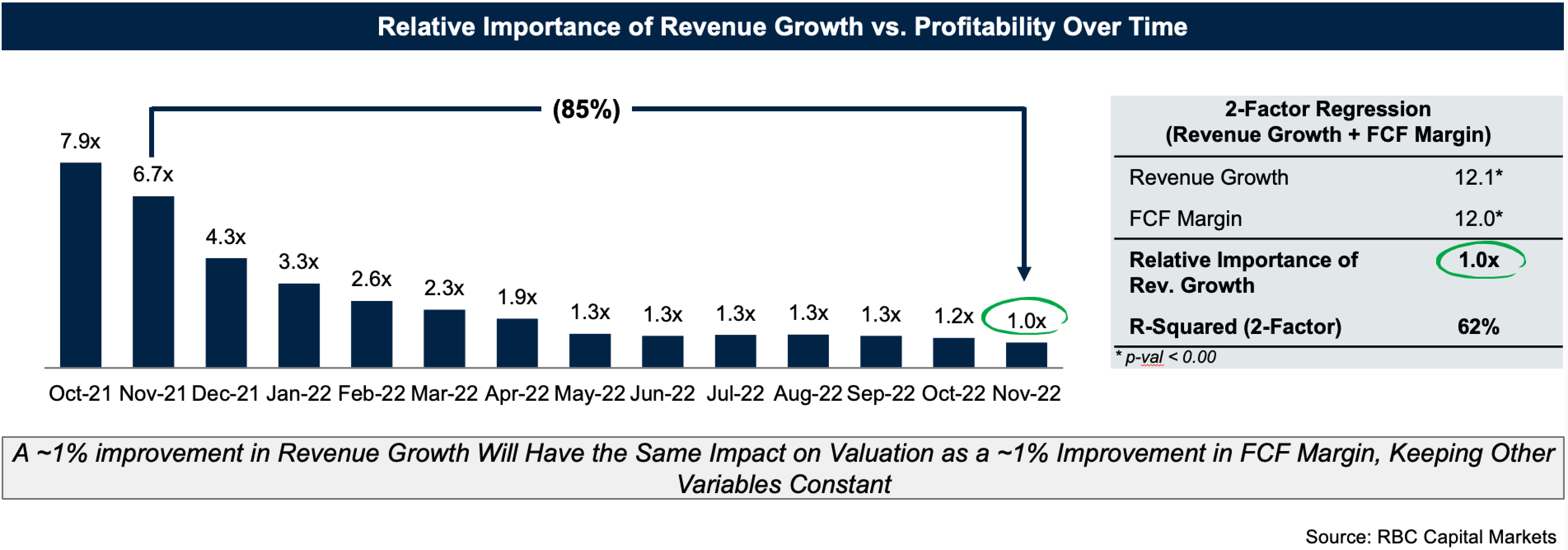

- A capital-efficient future. What worked to access capital over our black-swan bull will not work over the next 12-24 months. The relative importance of revenue growth vs. profitability/free cash flow as a driver of valuation has already decreased by over 85% since November 2021. Those that can demonstrate a legitimate path to profitability over a finite period while continuing to show strong growth, will prevail.

Introduction

The growth model for technology companies is fundamentally different from any other sector. They are often cash-burning enterprises, traditionally built for top-line revenue growth over bottom-line profitability, and therefore require capital partners to scale. This model places an excessive reliance on external capital to fund for the lack of free cash flow in technology companies across all stages, from pre-seed through to public. Though capital in its broadest sense encompasses both equity and debt, technology companies have relied heavily on the former – given the limited underwriting criteria (i.e. receivables, inventory, and cash) typically required for early-stage debt lenders.

Given that technology companies maintain a heavy reliance on angel, venture, or growth equity to support and scale their operations, they are equally vulnerable to market volatility. Throughout a 13-year bull run with consistently low-interest rates, growing venture capital dollars (both fundraised and invested), and strong government policy to support our growth – our ecosystem flourished. Not only was Canada able to establish a record number of new, VC-backed technology companies domestically, but we also earned significant attraction from foreign investors and corporate entities looking to invest in homegrown talent and recognizing Canada as a global technology leader.

As we kicked off 2022 with Russia invading Ukraine, central banks coming off cruise control realizing they enabled a record negative real interest rate, and that public tech stocks weren’t going to be valued at 2021 multiples in perpetuity – our ecosystem held hands and collectively entered a market that even the most seasoned weren’t familiar with. More precisely, macroeconomic factors brought forward by monetary and fiscal policy, interest rates, and inflation have completely altered the technology venture capital ecosystem, leaving many companies unsure of their ability to access capital and survive.

Macroeconomic factors impacting capital accessibility

To unpack the macroeconomic impact on our venture ecosystem, it’s key to understand the fundamental role of VCs: to match the capital raised from limited partners (LPs) with the capital needed to finance entrepreneurial ventures – all incentivized through financial returns.

For this to be realized, a few things need to be true. At its core, VCs must establish and nurture trusted partnerships with their LPs, maintain a consistent and healthy flow of qualified companies to deploy capital into, and have a liquid capital market landscape to exit investments and generate returns from. Over the past decade, and especially over the past two years, this all held true.

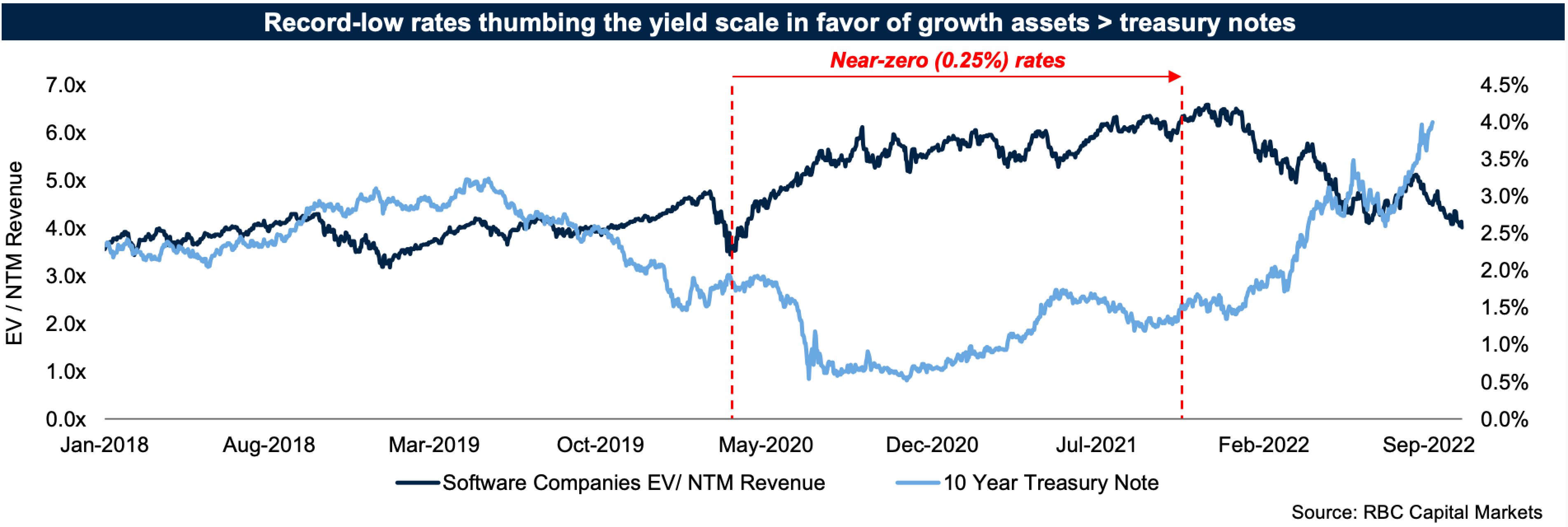

In 2021, near-zero interest rates fuelled $128B of VC fundraising in the US alone[1], making the asset class more attractive for LP capital compared to low-yielding fixed income alternatives (see below).

This capital attraction also held true in the public markets, where bond investors turned to the equity markets (i.e. growth stocks) in search of yield. With a public market environment flushed with new liquidity, primarily driven by a record flood of quantitative easing, low rates, and a pandemic-induced tech boom, our private tech ecosystem graduated a record number of companies to the public markets via an IPO or SPAC. As VCs witnessed the markets – and returns to their LPs – thrive, they were incentivized to deploy record amounts of capital in a record number of companies across all stages.

The story, as we know, has been quite different in 2022, as we have witnessed the Bank of Canada and Federal Reserve revert to raising rates at a record pace, triggering many second-order consequences on the venture capital ecosystem. Specifically, as rates rise, investors begin to re-allocate their capital away from equities and into bonds, growth-stocks are faced with demand suppression and multiple contraction, and our venture market gets hit with downstream ripple-effect comprised of lower valuations, lower deal velocity, and less control of securing fresh LP commitments. More precisely, a 1% increase in interest rates has been proven to impact venture capital in two main ways[2]:

- Decreases VC fundraising by 3.2% (as LPs revert to higher-yielding alternatives); and

- Increases VC investment demand by 2.5% (as debt holds a higher cost of capital)

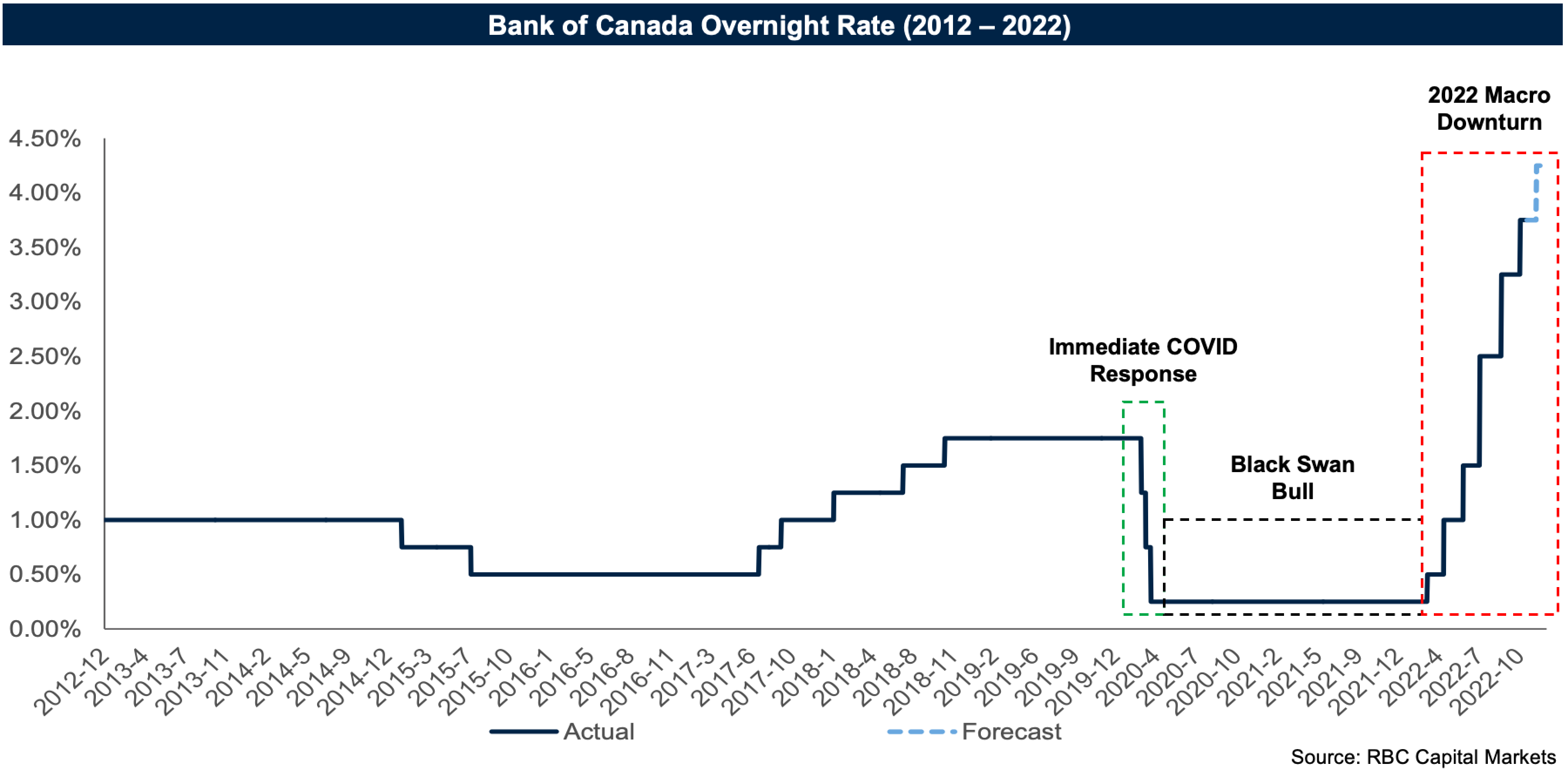

Why does this matter? In the first three quarters of 2022, central bank policy rates have already risen 350 basis points in both Canada and the US over six consecutive rate hikes, and is at its highest point since the 2008 GFC (see below) [3,4]. With the market pricing in peak federal funds rate of ~5.15% in June 2023 (3 more rate hikes)[5], our VC ecosystem across North America could see fundraising decline by almost 16% and demand increase by over 12% – building a near 28% capital supply-and-demand shortfall. For reference, almost $20B of US VC fundraising at risk is already more than Canada’s record $15B VC year in 2021[6]. The resulting implication will have entrepreneurs lose leverage in negotiating and completing deals on VC terms, which are expected to be more restrictive and scrutinized.

With rate hikes having an inordinate impact on our public and private technology ecosystem and overall access to capital, central banks have had no choice but to accelerate hikes to combat inflation.

With US inflation gradually building through 2022, to a point where we reached a new 40-year high in June 2022[7], public and private investors have abruptly shifted their investment priorities from a previous ‘growth-at-all-costs’ mantra to one focused on disciplined capital allocation, burn rates, and positive free-cash-flow (FCF). In a high inflationary environment, access to capital becomes increasingly difficult for two categories of companies: i) those that can’t absorb a higher cost base and, as a result, have their operating and FCF margins directly impacted, and ii) those that don’t have a clear path to profitability, which becomes particularly challenging for companies that are sub-scale and still looking to invest aggressively in go-to-market.

As public market valuations have strengthened their correlation to FCF as a driver of enterprise value, and inflation has yet to show signs of slowing down from demand suppression, continuous rate hikes are expected. And with central banks responsible for balancing higher rates and taming inflation with a consequential decrease in consumer spending and business investment (i.e. a recession), companies with strong retention rates and defensible moats will inevitably be rewarded.

Outlook on capital accessibility

Venture funds to normalize both deployment and fundraising cycles

As VCs prioritize a flight to quality – their capital deployment cycles (i.e. the period that they allocate to make investments) will normalize to the standard 3-4 year period, resulting in fewer deals getting completed and capital getting deployed, comparatively to 2021. Though there is a record amount of VC dry powder going into the last quarter of 2022 ($290B in the US)[8], with an uncertain macro-outlook impacting both public and private valuations, and to mitigate the risk of damaging LP relationships from potential investment mark-downs, the deployment of that capital will extend 3-4 years vs. the previous 12-18 month period. Furthermore, as 65% of the un-deployed $290B US funding was raised in the past 18 months alone[8], most of that capital remains at the early stages of their deployment cycles.

In addition to a normalized deployment cycle, VCs will normalize the time between raising their next fund (for those that can). This intuitively makes sense given that VC fundraising cycles typically happen once the active investing period has been completed (i.e. 2-4 years). Again, a resulting impact of less capital in our venture ecosystem.

Venture fundraising to take an ice-bath

The red-hot VC fundraising environment that padded the ecosystem over the past two years, underpinned by near-zero rates and strong public tech performance, will drastically cool down over the next 24 months. As central banks may require more frequent and prolonged rate hikes to combat unrelenting inflation, organic revenue growth and forecasts for tech stocks are at risk of further market cap degradation. The third-order effect will have LP portfolios further damaged and over-indexed in venture. As private and venture investments don’t benefit from the same real-time liquidity and valuation nature of our public markets, LPs have seen their public allocations lose ~40-70%, while their 2021 private investments are still showing record valuations, all on paper.

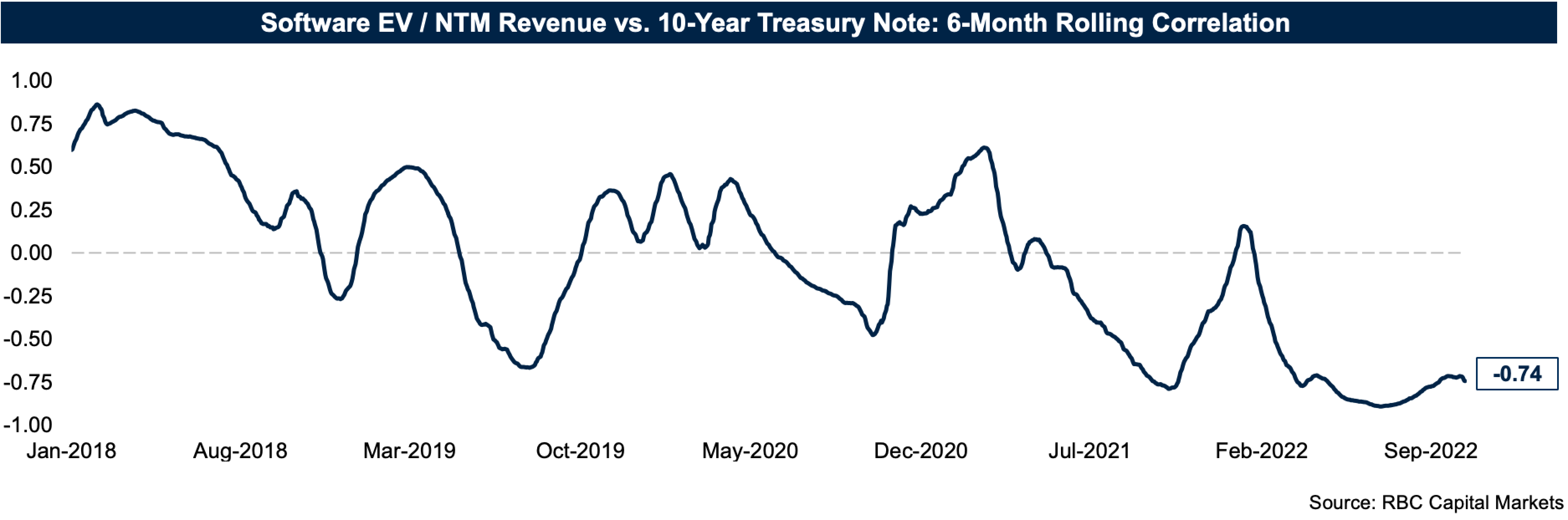

Furthermore, as mentioned above, interest rate hikes are negatively correlated with VC fundraising and growth valuations (see below).

As central banks continue to emphasize that ‘taming inflation is our number one priority’, LPs could revert to fixed-income securities in search of higher anticipated risk-adjusted yield.

Though H1 2022 reported $120B of VC fundraising completed in the US[8], this lagging indicator was most likely reflective of VC financings which kicked off during a hot H2 2021, given the typical 6-9 month VC fundraising period. With this 2021 fundraising hangover expected to be behind us, the market has been hearing more LPs speak of ‘heavily-slowed financings’ and ‘a reduction in involvement’ anticipated through the back half of 2022[9].

The last factor contributing to an expected VC fundraising ‘cooling-off’ period is regarding public market performance, specifically IPOs. IPOs have proven to be one of the largest drivers of venture capital investing, given their role as the primary vector for liquidity for private tech. As such, they serve as a barometer for our market’s appetite in the asset class. As the IPO window has remained effectively closed through 2022 and is expected to remain that way through 2023 and into 2024, LPs will be cautious in investing fresh capital in venture at a time where there is no viable off-ramp to generate returns from. And as for SPACs, July 2022 was the first month in over five years where there was zero new SPAC money raised – a stark contrast to the $36 billion raised last March[10].

Increased venture demand will be met with decreased venture supply

From Q1 2020 to Q4 2021, the venture ecosystem continued to provide founders with stronger leverage through their fundraising process over investors[7]. The resulting implication was record round sizes, valuations, and term sheets – as VCs needed to move fast and pay big to win deals. Through each quarter in 2022, the power dynamic (known as the VC dealmaking indicator) has consecutively increased in favour of investors across both early and late-stage deals. Why? As VCs anticipate allocating a greater proportion of capital towards supporting their 2020 and 2021 portfolio vintages and less on direct new investments, as they increase the level of diligence in their process, and as they raise the bar for investment-worthy candidates, the ease of accessing their dollars will decrease.

In addition to forecasted venture supply being impacted by existing funds, it will also be impacted by certain categories of funds, putting a pause on capital deployment entirely. As corporations reduce discretionary spending and focus resources on core areas of the business, those maintaining corporate venture capital (CVC) arms will pull back their activity. And this has already started to show – with Q3 2022 showing a 52% YoY decline in quarterly CVC deployment and only four new CVC arms launched in H1 2022, compared to 42 last year[10]. In addition to CVC arms, crossover investors who previously flooded our private ecosystem in 2021 have since retrenched, which will further decrease venture funding to both early and late-stage companies (but we will wait to go deep into this group in Part 3).

Lastly, with rates rising at a record pace, founders are expected to lean on the equity markets even further, given the sharp and newly amplified cost of debt. This will further rebalance the power dynamic between a founder-favoured capital landscape in 2021 to an investor-favoured landscape in 2022 – where only select companies can access venture capital on investor terms.

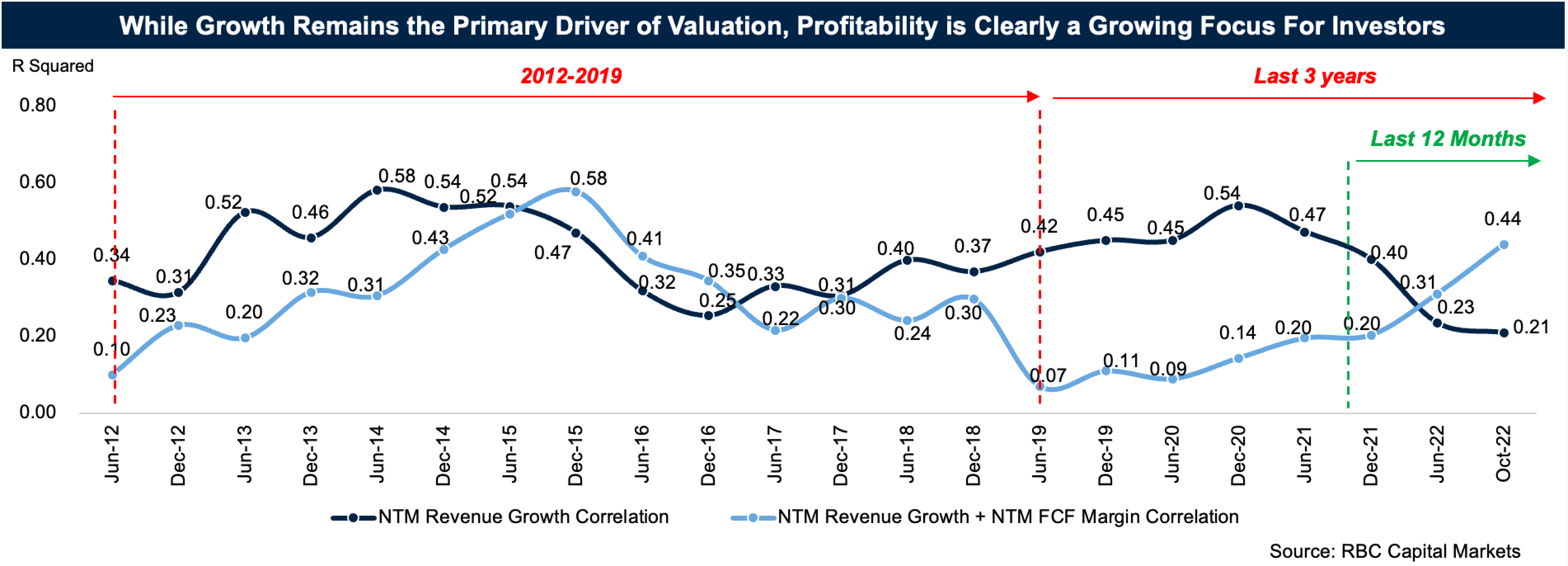

Venture investors will balance growth with efficiency

As the preceding two years were flush with cheap capital, what may have worked to access venture dollars then will not work over the next 12-24 months. For the first time in five years, revenue growth is no longer the leading factor, as investors have shifted their priorities towards balancing that growth with efficiency in the form of capital allocation, free cash flow, and profitability (see below).

More specifically, the relative importance of revenue growth vs. profitability (FCF) as a driver of valuation has decreased by 85% over the past 12 months (see below).

Investors will want to be introduced to a business that has established a path to profitability over a definitive period while continuing to show strong growth (avoiding showing higher growth at the cost of not getting to breakeven).

With this in mind, and knowing that revenue forecasts are always wrong, in a contractionary macro environment, VCs will become increasingly focused on the inputs founders can control: cost. This includes both where capital gets spent and at what pace. This story must be clear, concise, and built off a strong capital-efficient narrative for founders to access privileged VC dollars.

Conclusion on capital accessibility

Overall, the sudden change in macroeconomic policy following our black-swan bull and through the first three quarters of 2022 is expected to have a disproportionate effect on investors’ ability to fundraise and founders’ ability to access venture capital. As central banks begin to tighten monetary policy, further utilize rates to suppress consumer demand, and continue to favour negative GDP growth over rising inflation, public technology will continue to get hit. And as this naturally trickles down to our private markets, less capital on smaller round sizes will only be available to a select number of companies – those who can demonstrate disciplined capital allocation with quality, scalable revenue growth.

Stay tuned for the final two parts of The Outsourced Tech Economist, with part three looking at valuations and part four looking at business building. Read part one here.

References:

- https://pitchbook.com/news/reports/q4-2021-pitchbook-nvca-venture-monitor

- https://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2017-Athens/papers/EFMA2017_0125_fullpaper.pdf

- https://tradingeconomics.com/united-states/interest-rate

- https://tradingeconomics.com/canada/interest-rate

- https://ca.news.yahoo.com/what-fed-chair-powells-some-ways-to-go-interest-rates-194141992.html

- https://betakit.com/canadian-venture-capital-investment-hits-all-time-high-of-14-2-billion-in-2021/

- https://www.bloomberg.com/news/articles/2022-06-10/us-inflation-unexpectedly-accelerates-to-40-year-high-of-8-6

- https://pitchbook.com/news/reports/q3-2022-pitchbook-nvca-venture-monitor

- https://twitter.com/galeforceVC/status/1554505130619424769

- https://www.wsj.com/articles/spac-activity-in-july-reached-the-lowest-levels-in-five-years-11660691758

- https://pitchbook.com/news/articles/corporate-VC-pullback-downturn