John is a member of RBCx’s banking team, where he predominantly supports early-stage clients across capital fundraising and strategic growth. In addition to this role, John works alongside RBCx’s capital team on both direct, indirect (fund-of-funds), and strategic investment opportunities.

Ideas Worth Noting

For readers with only a few minutes to spare, here are this piece’s key takeaways

- Introducing: risk-off. Cyclical collapses are built into the typical structure of a 10-year venture fund, as they are more likely than not to experience a downturn during that time frame. Rather than evenly distributed ups-and-downs, this cyclicality is shaped by a gradual build (known as risk-on, where investors allocate capital freely), followed by an abrupt and sharp collapse (known as risk-off, where investors subside deployment from high market uncertainty). The conclusion of our black-swan bull was the catalyst moment that took our venture ecosystem out of a decade-long risk-on investing period and into 2022’s risk-off market.

- The power of rates. During the past 18 months, the terminal exit valuation for software companies has dropped ~70%. As technology and growth assets are highly vulnerable to rate increases – especially those that are cash burning and have profitability forecasted many years out – a 1% increase in rates can bring a 15-20% decline in valuation. With central bank policy rates already up 350 basis points and expected to break 4.00% at the final Bank of Canada rate announcement on December 7, 2022, our ecosystem’s valuation deterioration may not be over.

- Crossover distortion. During the black-swan bull, sophisticated hedge fund investors brought their troves of capital into our venture ecosystem – with the goal of arbitraging the late-stage private to public valuation spread. The sheer pace and scale of capital deployment that these investors maintained pegged our private ecosystem to one of an index strategy, where diligence and fundamentals were trumped for speed and valuation. Those who took advantage of this tourist capital, now have a significant uphill battle to climb.

- Large cap funds mean large cap markups. With a public and private capital market firing on all cylinders over the past two years, both general and limited partners established a record number of large cap funds (i.e. those over $250M). This increased the velocity of capital deployed by GPs into companies. As large cap funds require higher paper valuations and markups to justify subsequent LP fundraising (i.e. higher total value to paid-in-capital or TVPI), our ecosystem witnessed companies receiving valuations well-beyond their years and built a ‘valuation hunting’ culture over our black-swan bull.

- Valuation cleansing to commence. Unlike in the public markets where valuations move in both directions, the structural incentives that exist across the private venture ecosystem has established an expectation of continuously rising valuations (i.e. the later the round, the larger the valuation). This phenomenon has established a damaging association with respect to down rounds. As we look ahead over the next 18 months and witness companies who previously raised on 2021 highs hit the market once again, the structural dis-incentives for our ecosystem to accept honest down-rounds based on business fundamentals and performance, will inevitably be tested.

Introduction

There is a fascinating phenomenon in venture capital whereby cyclical collapses are built into its structure – meaning you have funds with 10-year life cycles who are more likely than not to experience a downturn during that time frame. As we have seen through 2022, when that is triggered, it completely disrupts capital allocation, valuation methodology, and market pricing. This cyclical nature is not evenly distributed with ups-and-downs, but rather, consists of a gradual build over a long period of time followed by a sharp and abrupt decline. This gradual build is known as risk-on – where investors experience macro tailwinds, invest LP capital freely, and move further along their investing risk curve. The risk-off period is an abrupt shock to the market, which occurs during an economic downturn, as investors swing all the way back in the opposite direction and see mass value destruction across public portfolios, initially.

Our venture ecosystem’s own risk-on period happened between 2009 and 2022, where rates remained near-zero, inflation was predictable, and the asset class earned greater institutional allocations (from pension funds, sovereign wealth funds, endowments, etc.). The risk-off period was triggered at the start of 2022, driven by our current macroeconomic environment. As the black-swan bull of the past two years was the concluding chapter to our peak risk-on period, it was also the point where VCs were furthest along their risk curves:

- Seed rounds were normalized at $10-20M vs. the traditional $1-2M

- Series A rounds were getting completed at pre-revenue and pre-product-market-fit

- Private and public software valuations were getting recorded at over 200x and 50x annual run-rate (ARR), respectively

- Infant businesses with minimal use cases, and big aspirations, got funnelled with capital (think Web3, NFTs, and alternative coins)

- Investment priorities shifted to speed and valuation over diligence and fundamentals, to get deals done

Now, with consecutive quarters of negative or declining GDP growth across both Canada and the U.S., companies that took advantage of this market cycle and received seismic valuations over the past two years are in a difficult position. They have been hit the hardest from their valuation peak, have been forced to abruptly cut costs, and now have a severe uphill battle to climb into what seems like a daunting valuation. Furthermore, the period between 2009 and 2022 has been the longest time between any two major downturns on record[1] – meaning the peak of this risk-on period for investors was the furthest they have ever been on their risk curve.

In thinking through the main macroeconomic and market drivers that took us from a decade long risk-on run, to an abrupt period of risk-off for public and private technology valuations, a few factors come to surface:

- Rising interest rates damaging valuation entry and exit multiples

- Crossover investors distorting valuation integrity and abruptly leaving

- The outbreak of large cap funds all hunting for large cap returns

- An overarching structural dis-incentive that exists for down-rounds across private equities

Macroeconomic factors impacting on valuation

Interest rates, inflation, and outlook

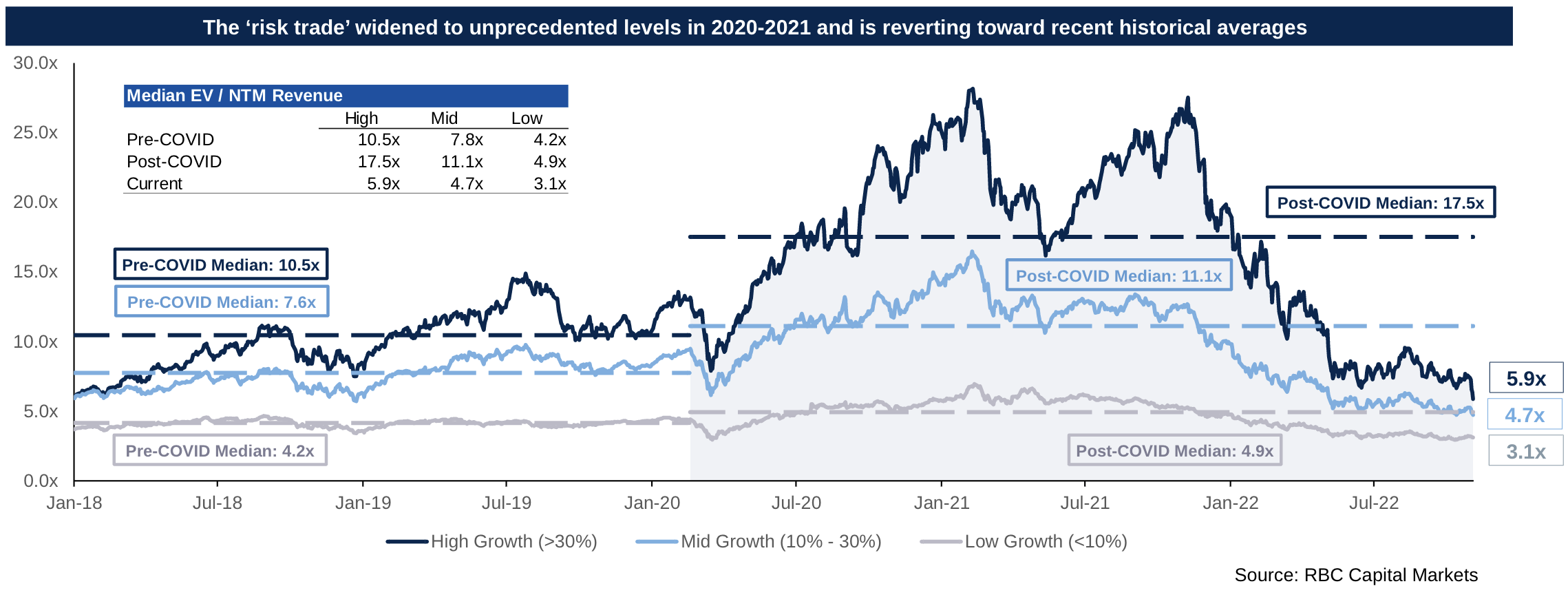

In February 2021, the median public software EV (enterprise value) / NTM (next twelve months) valuation multiple was 17.0x, while for high-growth companies (i.e. those growing top-line revenue above 30% YoY), it was 28.1x. As of October 2022, those two valuation multiples are now trading at 5.7x and 8.1x respectively, meaning the terminal exit valuation for software companies has dropped roughly 70% across the board (see below). Rising interest rates have played a lead role in this massive shift.

As the iron law of investing and valuation setting, a 1% increase in interest rates generally leads to a 15-20% decrease in valuation[2]. As we have managed to go from a comfortable near-zero interest rate environment to one now at 3.75% in under a year, tech companies as an asset class have been hit the hardest. Why? As discussed earlier in the series, tech companies have historically been cash-burning enterprises who primarily prioritized top-line revenue growth at the sacrifice of bottom-line profitability. Knowing this and given the exponential nature of discount rates used in typical discounted cash flow analysis, cash flows generated in the outer years are highly vulnerable to rate fluctuations and have a greater overall valuation impact (especially for those that are pre-profit). $1 today is worth a lot more than $1 promised eight years from now – especially as discount rates rise.

The other key macro factor to consider in determining the market outlook is expectations about inflation. With a 40-year record inflation print in June and at the risk of putting our economy in a recession, central banks have been utilizing interest rate hikes to suppress consumer demand – making mortgages, car loans, personal credit, and overall living costs more expensive. With a Fed destined to tame inflation, rate hikes will continue to be utilized, and as a result, continue to damage public technology valuations which will have a downstream ripple-effect on private equities all together.

Crossover investors – bull in a china shop

During the past 10 years, public and private technology investors managed a universally aligned and predictable process for setting valuations – driven from stable macroeconomic factors, extensive comparable and multiples analysis, and an overall understanding for what an investment-ready company looked like across every stage of the venture ecosystem. During the black-swan bull, as crossover investors brought their troves of capital over to the venture ecosystem – with the goal of arbitraging the late-stage private to public value spread – valuation predictability got blown up.

Following the initial March 2020 market downturn, public tech stocks struck lighting, driven off a few factors: the Federal Reserve/Bank of Canada abruptly slashing rates to near-zero, the government’s unprecedented quantitative easing campaign, investors pouring capital into growth-assets in search for yield, and technology being the asset class everyone turned to establish ‘the new normal’. As that happened, public tech companies were funnelled with new investor and retail capital, accelerated strong top-line metrics (revenue growth, customer count, etc.) and were granted with valuations that were 10x the previous 5-year mean. This glorified, artificial valuation distortion led many late-stage private tech companies to get tunnel vision on ‘going public’ – and with incentives aligned across companies, investors, and bankers – reduced all public barriers to entry.

With the inherent time-lag that exists for public valuations to hit private markets, sophisticated hedge fund (crossover) investors noticed that the spread between late-stage private and public became a lucrative market opportunity worth pursuing. More acutely, their thesis was one around an index strategy – whereby if they could invest their capital at speed and scale, across the most prominent IPO-destined technology companies, then their portfolio would capture sizable gains from the spread. In the spirit of playing to your strengths, crossover investors had two that they doubled down on through the past two years: the sheer amount of capital at their disposal and their ability to fundraise more of it.

As crossover investors infiltrated the late-stage (and afterwards early-stage) private market, they came in like a bull in a china shop. In under a year, they managed to deploy a record amount of capital, across a record number of companies, at record pace – to a point where in Q4 of 2021, Tiger Global, a leading crossover and hedge fund investor, averaged over 1 completed deal a day[3]. As venture investors noticed some of the most sophisticated investors enter their arena and deploy large sums of capital on huge valuations – and see it initially paying off – confirmation bias set in. Venture investors began to break their own records across both capital deployment and fundraising, and the entire private market valuation methodology became pegged to one of an index strategy – based on fast capital deployment on huge valuations. A previous clean and universally understood private valuation methodology now became predicated on “if I buy for x, someone will buy for x+y” and that ripple-effect made its way through the entire spectrum of venture investing.

It soon became clear to the market that these valuations were propped up by a historic macro environment – and when inflation soared, geopolitical conflicts rose, supply-chains broke, and purchasing power deteriorated – they all got exposed. Public valuations reverted to under their previous 5-year median, IPO markets completely froze, and a sense of uncertainty entered the private markets. Investors who poured money into private companies at historic valuations saw mass value destruction across all their investments, at every stage, and for the big crossover investors that initiated this distortion – they reported mass losses[4] and retrenched on capital deployment entirely[5].

With companies across the entire spectrum being impacted by this valuation sobering, they are all faced with differing underlying issues. For late stage companies, specifically those who raised at the 2021 valuation peak, they have been forced to urgently cut costs to buy time and shift their P&L to one based on profitability and free cash flow – so that they can control their own destiny when it comes to financing the business and not needing to rely on expensive and highly-dilutive external capital. For early stage companies, where investors deployed capital furthest along their risk-curve, they now must show fundamental progress in the business to get further capital – across product, technology, commercialization, and scale.

Large paper mark-ups used to justify new large cap funds

With a liquid public market landscape and an abnormally strong macroeconomic cycle over the past few years, both general and limited partners further contributed to private tech by establishing a record number of large cap funds in 2021 – those above $250M. Specifically, and in the U.S. alone, 2021 recorded 78, 45, and 22 venture funds launched between $250 – $500M, $500M – $1B, and +$1B[6], a 100%, 137%, and 120% increase from 2019, across each tier. When aggregating the total venture dollars raised across those tiers, 2019 recorded $45B of large cap fund capital raised, whereas 2021 recorded $102B – an increase of almost 130%[6].

With a historic large cap fund explosion in 2021, two primary second-order effects impact our private capital ecosystem: i) with more capital committed, the velocity of capital deployed must increase, and ii) with larger funds needing to return more capital, GPs are incentivized to push higher paper valuations as a means of justifying subsequent fundraising and LP return expectations.

To overemphasize the former, let’s take Softbank’s Vision Fund II, raised in 2019 at $100B USD[7]. Structured as a ten-year fund with a typical five-year investment period, that is $20B invested annually, over $1.6B invested monthly, and over $400M invested weekly. With such a demanding deployment cycle, the quality of diligence by necessity is sacrificed and the market becomes both frothy and unfortunately, highly speculative. Comparing that pace to 2022, it is quite the opposite from the single investment Softbank Vision Fund II made in August and September respectively[8].

The more critical second-order consequence to an increase in large cap funds is due to the inherent nature of how venture capital is managed, with paper markups and total value to paid-in-capital (TVPI) being the lifeblood of the industry. Regardless of the fund size, all GPs regularly update their fund’s worth by using TVPI to show the aggregate valuation sum of each of their fund investments. Theoretically, this is used as a barometer to assess a GP’s investing ability and for LP’s to manage their own private portfolio values and future return expectations. For GPs to have a chance of raising their next fund once their five-year deployment cycle is over, TVPI must be in the upper-quartile. Knowing this, when the venture ecosystem is flooded with a record amount of large cap funds and LP capital ready to be deployed, GPs must justify more frequent and higher valuations to invest at.

For example – to return just the initial capital of a $100M fund, that could mean owning either 10% of a $1B company or 25% of a $400M company – which both seem like a manageable objective for an experienced GP. But for a fund size of $1B, that could mean owning either 10% of ten $1B companies or 25% of ten $400M companies – and that is just to breakeven on the fund capital (I.e. not considering fees, preferred hurdles, carry, etc.). This dynamic of venture capital not being able to simply scale by fund size, has been exemplified over the previous four consecutive quarters, with US funds under $250M significantly outperforming those above, across pooled IRR[9].

By signing up for managing a large cap fund, GPs are forced to make large cap fund investments at much higher paper valuations to drive TVPI and hopefully provide a strong return (through actual distributions) to their LP base. And this dynamic no doubt contributed to the mass valuation hunting that took place over our black-swan bull.

Structural dis-incentives regarding private down rounds

As discussed earlier in the series, the growth path for technology companies is to utilize venture and private equity markets to access the capital needed to scale. Starting at the pre-seed or seed stage and ending as a publicly traded company or standalone established enterprise, there is an underlying assumption that is baked into the private capital fundraising ecosystem: the later the round, the larger the valuation. More specifically, as companies grow and raise further equity rounds, their valuation will always be expected to increase. This assumption has built a culture of viewing down rounds (i.e. when a valuation is given to a company at one less than their last previous round) as a negative and almost detrimental manner to do business in the venture markets. Why? For a variety of reasons:

- Investors may damage their fund reputation, future deal-flow, and ability to fundraise from new LPs,

- Existing LPs witness their capital being marked down and new LPs enter at a time where the company is not on the rise – leaving neither group excited,

- The founders’ equity is severely damaged (especially from pre-existing anti-dilution provisions) leaving them dis-incentivized and contemplating their own risk-reward trade-off,

- The employees of the company have their stock-based-compensation or registered stock units (RSU’s) damaged and potentially even out of the money – impacting both culture and retention; and

- The company’s external brand and market perception is damaged – impacting their potential ability to do future business.

Over the past two years, with investors armed with a record amount of capital to deploy, companies were given seismic valuations and everything was getting marked up. With deal diligence getting trumped by speed and size (as crossover investors became the new private market pacesetters), companies became accustomed to being granted with higher valuations and more capital every time they hit the market.

Unfortunately, the fact of the matter is that there were many instances over the past two years – where capital was deployed into companies at valuations well beyond their years – simply based on the market being valuation-driven over fundamentals-driven. With a record venture market, the ecosystem became focused on external metrics – such as how much certain investments could be marked up, how much the market would pay for a company today, and how many unicorns one could get in their fund. Conversely, given the lack of time set aside for diligence, conversations around the quality of earnings, business metric fundamentals, and the longer-term competitive value creation of the business were not as prioritized.

As we look ahead over the next 18 months and witness companies who previously raised on 2021 highs hit the market once again, the structural dis-incentives for our ecosystem to accept honest down-rounds based on business fundamentals and performance, will inevitably be tested.

Outlook on valuations

Prolonged inflation will lead to further increased rate hikes and valuation degradation

Though inflation prints of 7.7% (US)[10] and 6.9% (Canada)[11] in October is a move in the right direction to get inflation under control, it is still nowhere near the central banks’ 2% target and will do little in adjusting monetary and fiscal policy plans. As consumer confidence is now at the lowest it has been since February 2021 (and one of the lowest points ever)[12], market outlook and expectations regarding inflation, unemployment, and purchasing power all lead to an inevitable result – further increased interest rates and quantitative tightening. With the Fed signalling ending 2022 and 2023 with an interest rate between around 4.25% and 5.0% respectively[13], investors can expect public and follow-on private software valuations to be at risk of being further impacted by 10-15% if inflation is not controlled. And for software companies that raised at the February 2021 multiples peak, not only does building a plan to roll-into their previous valuation seem like a heroic undertaking, but they now must keep up with further valuation degradation driven from tight monetary policy. Remember, for a unicorn to build back and earn its previous valuation after being damaged by 70% (down to $300M), it’s not a matter of simply earning that 70% back (as that would only reach $510M). Rather, that business must earn valuation growth of over 230% to obtain their previous $1B mark!

Investors will build back a clean process for valuations across

The average deal size for seed, early, and late stage US venture deals in 2019 was $2.6M, $15M, and $29.1M, respectively. In 2021, those numbers were $3.6M, $22.1M, and $52.1M[6]. Said another way, the average US venture deal size has grown 37%, 46%, and 79% respectively in just two years. Furthermore, the average pre-money value across the same dataset in 2019 was $8.8M, $63M, and $292M, whereas in 2021, those numbers were $13M, $110.7M, and $677M – increases of 47%, 76% and 132% respectively[6].

The disconnect that built over the past two years, across both deal size and pre-money valuations, will now have investors revert to the five-year mean and manage allocations much more closely to public company multiples (I.e. no more 200x ARR multiples). Especially as crossover investors wind down their venture allocations and private valuations get re-adjusted (as seen from Tiger’s recent stark markdowns on their previous three funds)[14], our venture ecosystem will build back the specific metrics, milestones and requirements needed to fundraise and access venture capital across each stage.

Without access to inside / bridge rounds – down rounds will normalize throughout private financings

Understanding the outsized role that macroeconomics played in driving private and public technology valuations over the course of the past two years, as the market now begins to normalize, valuations will follow. This shift will force many private company down rounds, especially for those who cannot secure inside or bridge rounds with current investors at preferential discounts or valuation caps. Though Instacart and Stripe became the initial two cases of private company valuation cutting in 2022 (following a 409A valuation)[15,16], many other companies have since followed their path. Kroll, a third-party valuation advisory firm, noted that they have advised over 50% of their late-stage and pre-IPO clients to cut their valuations, over just the past few months alone[17].

Instead of being solely viewed negatively, investors and the market should view down rounds (for companies who raised during the black-swan bull) as a sign of company progression – seeing as though with tighter investor scrutiny across capital allocation and a tougher macro environment, the business and team remained resilient in raising capital. Looking ahead, our ecosystem will witness companies who raised in 2021 fall into three buckets: those that raise again on an up or flat round (market leaders), those that raise again on a down round (market takers), and those that can’t raise again and wind down (macro swindlers).

As public valuation metrics have sharply reverted in 2022, down rounds will enable late-stage companies to match their valuations with the terminal exit value in public markets and reposition it as a viable vector for liquidity. And for companies that have a definitive timeline before expecting to access the public markets, this will mean many IPO down rounds over the next 24 months. Unfortunately, this will only be available for late-stage companies who can either i) go public already profitable, or ii) have a deliberate plan to achieve profitability within two quarters. At a recent investor meeting, Morgan Stanley noted that 88% of their global investor base would only invest in a growth tech IPO if it was profitable at IPO, breakeven, or breakeven within 0-6 quarters[18]. With a 69% YoY increase in unicorn births (517) and 147% YoY increase in large cap rounds globally (1,556)[6] – 2021 will be remembered as the year that triggered the normalization of down rounds across our private capital markets and will only strengthen our ecosystem over the long-run.

Conclusion

In reviewing venture capital performance over the past 25 years, the last vintage where our ecosystem recorded a negative IRR and distributions to paid-in-capital (or DPI) under 1.0x after the 10-year fund cycle concluded, was in 2002, right after the dot.com bubble – where valuations had their own challenges[19]. More likely than not, given the distorted valuation pacesetting by crossover investors and abundance of sheer capital being deployed from large cap funds hiking up entry prices, 2021 will not be a strong performing venture capital vintage.

As the macroeconomic environment ahead will place further downward pressure on valuations from increased rate hikes, re-establish our universal process for venture fundraising, and drive valuation sobering in the form of honest down rounds – investors will enter the next era of our risk-on period focused on allocating capital to only the best and brightest. And I for one could not be more excited to do the same.

Stay tuned for the fourth and final instalment of the series during the week of November 28th, and see below for the first two pieces:

- Part 1 – How a black-swan bull upended the tech ecosystem

- Part 2 – Why our tech capital reservoir will now look dry for many

References

- https://twitter.com/MacroAlf/status/1550254543883026433

- https://www.paddle.com/blog/saas-valuations-are-changing

- https://www.cbinsights.com/reports/CB-Insights_Venture-Report-2021.pdf

- https://techcrunch.com/2022/05/10/tiger-global-hit-by-17b-hedge-fund-losses-has-nearly-depleted-its-latest-vc-fund/

- https://pitchbook.com/news/articles/tiger-global-pumps-the-brakes-on-vc-deals

- https://pitchbook.com/news/reports/q2-2022-pitchbook-nvca-venture-monitor

- https://group.softbank/en/news/press/20190726

- https://asia.nikkei.com/Business/Business-Spotlight/SoftBank-adjusts-its-vision

- https://pitchbook.com/news/articles/are-bigger-vc-funds-better

- https://tradingeconomics.com/united-states/inflation-cpi

- https://tradingeconomics.com/canada/inflation-cpi

- https://www.bloomberg.com/news/articles/2022-07-26/us-consumer-confidence-drops-to-lowest-since-february-2021#:~:text=US%20consumer%20confidence%20declined%20in,in%20June%2C%20data%20Tuesday%20showed

- https://www.bankrate.com/banking/federal-reserve/fomc-what-to-expect/

- https://www.theinformation.com/articles/tiger-global-slashes-value-of-private-tech-bets-by-billions-documents-show?utm_source=ti_app

- https://www.cnbc.com/2022/03/25/instacart-slashes-valuation-by-almost-40percent-to-24-billion-.html

- https://www.wsj.com/articles/stripe-cuts-internal-valuation-by-28-11657815625

- https://pitchbook.com/news/articles/valuations-409a-cuts-instacart-forecast

- https://twitter.com/glennsolomon/status/1561125169342517248/photo/1

- https://www.cambridgeassociates.com/wp-content/uploads/2020/02/WEB-2019-Q3-USVC-Benchmark-Book.pdf